5.3 Market Sizing

A frequent problem that you'll encounter as a PM is trying to assess whether or not it's worth pursuing a specific business opportunity. For example, if your company wants to build a product for managing collections of vintage oil cans, you probably won't have many potential buyers. Would the limited number of potential buyers even be able to afford your product? Will there be enough of them to justify the cost of creating the product? How many of them could you realistically capture?

Product managers need to answer these types of questions while working with imperfect information. For instance, finding the total number of vintage oil can collectors in the United States could be impossible. But you still need something to base your recommendations on. In this checkpoint, you will learn how to turn imperfect information into reasonable guesses.

By the end of this checkpoint, you should be able to do the following:

- Conduct a market sizing estimation

- Answer estimation questions common in PM job interviews

What is market sizing?

Market sizing is the process of estimating the potential customer base for a product. You'll most commonly estimate the money spent in the market, the number of people in the market, changes in the market size over time, and other metrics that are specific to that market.

For example, if you were working on a product for first-time parents, you may be interested in the number of people who have their first child in a given year, the average amount of money first-time parents spend on similar products, and the trends and changes to these numbers in recent years (such as people having fewer kids or parents spending more money).

The video below gives a brief overview of the importance of market sizing in the product management realm.

As a product manager, you'll need to care about market sizing for a few reasons. First, when you launch new products, you'll need to answer the questions "Is it worth going into this market?" and "How big is the market?" Estimating the potential customer base is an essential step to making these recommendations.

Second, you'll need to differentiate between different types of market sizes: all potential customers, the market that already has a solution, and the market share that doesn't yet have a solution. These different segments of the market differ in value and may call for unique features or differing marketing approaches.

Finally, estimation and market sizing questions are commonly used in PM job interviews. You need to be able to answer them on the fly, even if you don't have time to research any data. Don't worry, though—getting the right answer is not important. And, in fact, there is often no right answer. For instance, you may be asked to estimate the number of people around the world who are asleep right now or the number of taxis in NYC. Interviewers don't ask these questions because they want to see if you know the answer; they are interested in how you think. The method you use to logically approach an estimation problem will demonstrate whether or not you have the analytical skills to be a successful PM.

Types of market sizes

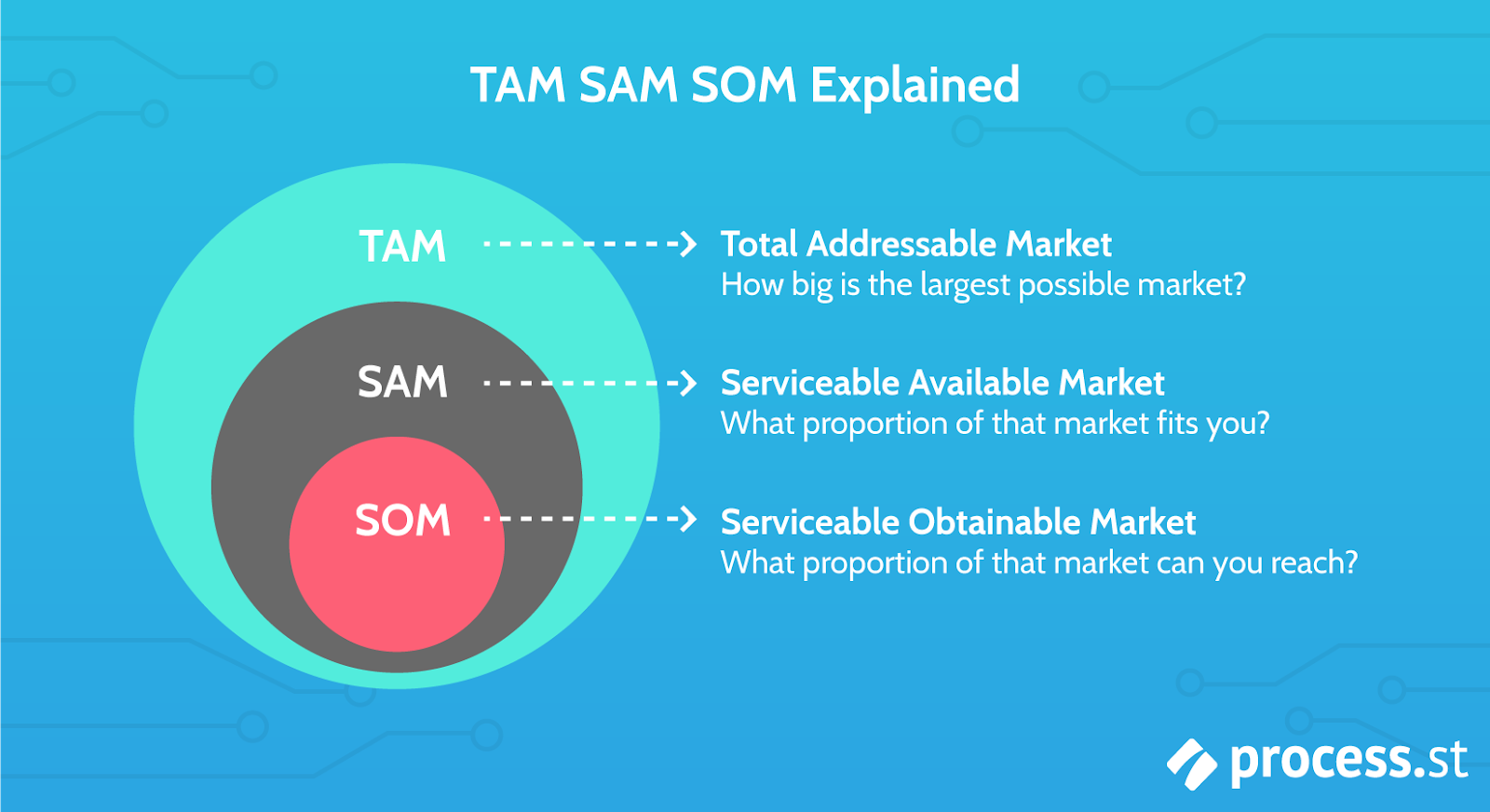

Market size is an ambiguous term that can mean different things. Product managers will generally consider the following: total addressable market (TAM), serviceable addressable market (SAM, also referred to as serviceable available market), and serviceable obtainable market (SOM, also sometimes referred to as share of market).

The total addressable market (TAM), is the market of all possible customers for your product. For instance, if your product is a private library and you're planning to design it to be used by anybody and you have the resources to launch nationwide, your TAM is the population of the United States.

The serviceable available market (SAM) is the group of people who could become users or buyers of your product. They may already have a solution to your problem or otherwise indicate they are likely to become your customers. Although not all members of the SAM will actually use your product, this is the segment on which marketing and sales efforts would most likely focus. For the library example, this is the group of people who already regularly use libraries. About 100 million people in the US visit a library each year, so you will use that data point to start your estimation.

The serviceable obtainable market (SOM, also known as share of market) represents the part of the addressable market that could potentially be reached. These are the people who don't yet use any other product and are looking for a solution. For the current example, this one is tough—around 200 million Americans don't go to a library each year, but what percent of them could you reasonably acquire for your new library? How could you figure out a reasonable, logical way to estimate this?

Finally, market size is also used to mean the dollar value of the market. This is usually the total amount of money spent in that market added together. So the total market size of libraries would be the amount that patrons, governments, universities, and others spend on books, personnel, real estate, technology, and everything else that goes into the operation and maintenance of libraries. Including archival services, this is estimated to be about $17 billion in 2018.

Market sizing formula

These market size terms may be used to develop a basic market sizing formula. If the TAM is equal to the market of all possible customers, then:

- SAM = TAM − those who can't buy the product

And focusing more deeply on the people that could buy the product:

- SOM = SAM − those who won't buy the product

Therefore, the high-level possible market share formula would look like this:

- SOM = total possible market − people who can't buy the product − people who won't buy the product

Estimation techniques

If you were asked to calculate the market size of video game laptops in the world or day care providers in New York City, how would you do it?

It would be nice if you could spend the time and get exact answers to your market sizing questions. However, getting that exact data can be extremely time-consuming and resource-intensive. You need shortcuts that get you good enough answers and allow you to make quick decisions. The following estimation methods can help you do just that.

Top-down estimation

With the top-down estimation method, you start with the greatest possible number and make reasonable guesses to reduce it until you reach the estimated number. For example, if asked to estimate the number of piano tuners in Chicago, you could start with the greatest relevant number: the population of Chicago. From there, work your way down:

- population in Chicago to

- families in Chicago to

- pianos per family to

- frequency of piano tuning to

- productivity of tuners

This progression will allow you to come up with a reasonably logical estimate. Some of these numbers will be based on guess, but others could be easily researched. You may quickly sketch out the following table:

| Data | Your guess |

|---|---|

| Population of Chicago | 2.7 million |

| Average family size | 4 per household |

| Pianos per family | 1 out of 5 |

| Frequency of piano tuning | Once per year |

| Productivity of tuners | 3 pianos per day |

Now, you can do some math to put all these numbers together:

| Data | Your guess | Running total |

|---|---|---|

| Population of Chicago | 2.7 million | |

| Average family size | 4 per household | 675,000 families |

| Pianos per family | 1 out of 5 | 135,000 pianos |

| Frequency of piano tuning | Once per year | 135,000 annual tunings |

| Productivity of tuners | 3 pianos per day | 45,000 days of work for all tunings |

Now all that's left is to turn 45,000 days of tunings into a number of people. There are about 250 working days in a year (365 minus holidays, weekends, and sick days), so 45,000 / 250 = 180. You estimate the market opportunity for piano tuners in Chicago includes 180 people.

It's best to use top-down estimates when you know (or can guess) the big number to start with. Note that you can alter individual terms in the equations to generate a range of possibilities. For example, what would the market be if the average tuner could tune four pianos per day instead of three? What if pianos only needed to be tuned once every two years? When presenting a market opportunity analysis to stakeholders, a thorough product manager will offer a range of values and explain the varying scenarios that could affect market sizing.

Bottom-up estimation

Bottom-up estimation is just what it sounds like—you start with the smallest number you know and work your way up to the final number. Say you're trying to predict your revenue from a new application that would allow users to order concessions from their seats at NBA basketball games. From some basic research, you know a few numbers already:

| Data | Number |

|---|---|

| NBA teams | 30 |

| Games per season per team | 82 |

| Average seats per NBA arena | 18,000 |

In order to make assumptions about how this translates to revenue for your application, you would need to know the average attendance per game, the average amount spent per person per game on concessions, and the percent of attendees who would use the application.

You could research some of these numbers easily—average game attendance, for example—but others you'd need to estimate and then document your assumptions. From these values, you could then estimate how much revenue the order-from-your-seat app might generate per game, and thus, per season. This might look something like this:

| Data | Number | Calculation | Running total |

|---|---|---|---|

| NBA teams | 30 | -- | -- |

| Games per season per team | 82 | 82 × 30 | 2,460 games |

| Average seats per game | 18,000 | 18,000 × 2,460 | 44,280,000 seats |

| Average attendance per game | 80% | 44,280,000 × 0.8 | 35,424,000 attendees |

| Amount spent per person per game | $25 | 35,424,000 × 25 | $885,600,000 spent total |

| Percent of people who will use your app | 25% | $885,600,000 × 0.25 | $221,400,000 app revenue per season |

| App revenue per game | $221,400,000 ÷ 41 | $5,400,000/game |

While some of the numbers used in this estimate are guesses, they don't have to be blind assumptions. For instance, you could estimate the app use rate you can expect based on the success of a similar app you launched for concert goers. You could also present to stakeholders the market opportunity impact if the application turns out to be more successful than anticipated (such as a 35% use rate) or less successful (such as a 15% use rate). What would the revenue per season or per game be in those cases?

Tips to improve your estimates

Estimation is a skill that you'll get better at with practice. Here are some tips you should keep in mind as you build your estimation skills.

Consider the edge cases

One advantage of estimation is that the smallest edge cases are usually so small that they won't affect your estimates. However, some cases are meaningful enough to make a difference. Take the NBA concession example above. The preseason and playoff games were not included in the list. That's a few hundred additional games, which would add 20-30% to your final number. Be systematic as you go through your estimation and try to avoid these errors.

Check your work

At the end of your estimating process, it's always worth doing a quick "sanity check" to make sure that your numbers look reasonable. Review not only your final number but also any intermediate numbers along the way. In the piano tuners example above, if your estimate resulted in 100,000 piano tuners, would that make sense? Check for any math errors. A multiplication error could drastically affect your answer. For instance, there was a logic error above in the NBA app estimation. Did you notice it? If not, can you go back and figure out what it was?

The calculation was based on 30 teams times 82 regular season games, but each game has 2 teams playing. The estimated numbers are all double what they should have been.

When unsure, estimate your error

You're not going to have great estimates for every number. When you're really unsure, you can take a guess while also estimating how wrong you may be. For example, if you don't know the average amount spent per person per NBA game on concessions, give it a range that includes how wrong you think you are—say, $20-$45 per person per game. This lets you keep going while also accounting for your uncertainty.

Work in round numbers

Math can be difficult, especially if you're doing an estimate in a stressful situation like a job interview. To avoid simple math errors, try to work in round numbers as much as possible. For example, if you're estimating annual take-home pay for Lyft drivers, you might start with their pay per hour, then multiply that by the number of working hours per year. For a 40-hour workweek and 52-week year, there are 2,080 working hours per year. However, multiplying numbers by 2,080 is laborious. Use 2,000 instead—this will help you avoid calculation errors, and it won't affect your final number much.

Use proxies

You may be asked to do estimates on things you're unfamiliar with, like the number of car garages in Seattle. In fact, you don't even know how many people live in Seattle, and you can't ask your interviewer to give you a moment to Google it. What do you do? Start with a number you do know. For example, say you know that there are about 10 million people in NYC, and you think Seattle is maybe one-tenth the size of NYC. Start your calculation off with, "Let's say Seattle has one million residents." These proxies can help fill in the gaps for your estimates.

Memorize some basic facts

It can help to know a few basic numbers to reference when you get asked an estimation question. For example, there are about 7.8 billion people in the world, about 325 million people in the United States, and about 8 million people in New York City. Pay attention to the news, conversations, or other sources that offer these bits of data, and commit them to memory. They may come in handy.

Data sources for estimation

While job interviews will usually require you to guess and use proxies to run your estimation, it's important to remember that on the job—and whenever you can—estimated values can be made better with research. There are several paid and unpaid sources that could help ensure that your estimates are on the right track.

Governments

Local, state, and national government agencies have extensive information about industries, population, demographics, and other topics. The Data.gov website serves a table of contents for much of the data available from the US government. Another terrific resource is the American Time Use Survey. Similarly, SEC filings of companies have information about their business, communications to stockholders, and more.

Research analysts and web services

Research analysts, such as Gartner and Forrester, are service providers that specialize in market segmentation and analysis. They provide detailed reports that you may find useful. Some of these sites are subscription-based, and others will allow you to purchase specific reports without a subscription, which could be more cost-effective.

Google and Facebook tools

A common way to assess the market size for a specific product—say Pez dispensers—is to ask: how many people are searching for Pez dispensers? Google and Facebook provide some of this data via tools, like Google Trends for search queries, Google Ads for specific search queries, and Facebook's ad planner for population sizes. Many companies have similar tools, so make use of them for your estimates.

Wikipedia

Wikipedia is an easy starting point for learning about many subjects, and articles often include references to sources that can give you the real data. But beware: Wikipedia content can be, and often is, modified without verification. Critically examine the sources cited, and only rely on data found in those you believe to be reliable.

Friends and family members

If you know someone who's an expert or has more than just common knowledge of a subject, it could be worthwhile to ask them for guidance or even a referral to a good source of information or another expert. Educated guesses are better than general guesses.

Estimation alternatives

Top-down and bottom-up are not the only methods of estimation. If you have more time and resources, you can try one of the following methods.

Expert judgment

Find experts in the appropriate field to give you their assessment of the market. The info that you're having trouble finding online might be something an expert knows by heart.

Wisdom of crowds

If you have access to a large enough group of people to ask, you can average out all their estimations. The average will often be closer to the actual number than any person's individual guess. This even works if you take this average from lots of experts' individual answers.

Modeling

Modeling is the method of building a predictive framework or tool for the purpose of predicting outcomes. These models allow you to play with individual factors to estimate different effects. Take the NBA app example above. What happens to the estimate if concession spending drops by 30%? What about if the NBA adds additional games in a season? With models, you have the ability to project possible outcomes by tweaking just a few small numbers. It takes much more effort to build, but it can be worth it if you need to understand or track how individual factors affect your outcomes.

Practice

First, choose one of the following estimation challenges:

- Total addressable market for smartwatches

- Serviceable available market for parents employing a nanny nationwide

- Serviceable available market for people using a meal kit service

- TAM, SAM, or SOM for a product you are interested in working on for a local employer

Estimate the market size. Do your own research—do not Google the entire phrase. Think about the estimation method you'd like to use and the steps you would need to go through to make an informed estimate. Then, try to find some data to help you fill in the gaps.

Second, choose one of the following blind estimation challenges:

- Number of cups of coffee sold in New York City in a year in 2022

- Number of iPhone applications downloaded in 2022

- Number of users having ChatGPT paid membership

- Annual revenue of Paypal in 2022

Pretend you are in a job interview and are asked to make an estimation on one of these. In this scenario, you don't have access to external resources and can't do online research. List the steps you would take as if you are taking an interviewer through your thinking process. It's important to practice your estimation skills so you can be confident approaching these types of questions in job interviews and throughout your career.